Hewlett Packard: The Tech Titan Few Education Activists Talk About

Increasingly people are casting a wary eye in the direction of Silicon Valley, concerned about the power its billionaires wield over public education and society generally. While Gates, Zuckerberg, Hastings and Bezos have grabbed much of the spotlight, there is another tech influencer with a long reach that less well known. In this post I will examine the William and Flora Hewlett Foundation’s grants in the area of “effective philanthropy” as they relate to the creation of an economic and policy infrastructure intended to advance social impact investment interests in the United States.

Established in 1966, the foundation is headquartered in Menlo Park, CA. Funds originated from Hewlett Packard co-founder Bill Hewlett. The foundation is one of the largest philanthropies in the United States, dispersing over $400 million in grants per year. Giving areas include: education, environment, cyber, performing arts, global development, strengthening democracy and effective philanthropy. They also manage special projects and donate to initiatives in the Bay Area. The firm, which went public in 1957, is a symbol of the region. HP has long been a leader in hardware and software sales. In 2015 their printer and personal computing business split off from their enterprise business creating two separate firms, Hewlett Packard (HP) and Hewlett Packard Enterprise (HPE).

Why did they need to re-engineer philanthropy?

Before diving into the particulars, it’s important to understand the economic driver behind these so-called philanthropic gifts. Huge markets are anticipated to open up in data-driven government contracting around both social service delivery and climate change management tied to the UN’s Sustainable Development Goals. But before that can happen, governments need to be convinced, non-profits have to be trained, and the infrastructure to gather and assess “impact” has to be put into place. High-level executives and policy makers have been working on this for over fifteen years through New Profit’s “A Gathering of Leaders” and “America Forward” and Results for America. Both New Profit and Results for America have received HP support.

An emphasis on data-driven philanthropy serves HP’s corporate interests in myriad ways. HP and HPE can sell more devices and software. They can sell enterprise solutions including predictive analytics like the “Voice of the Citizen” social media sentiment monitoring platform. HPE is also making inroads in the Smart City market with its Universal IoT Platform. Venture philanthropy requires IoT and geo-location systems to assess “anywhere” learning and capture impact data.

Last year they teamed up with Yet Analytics out of Baltimore on EIDCC, an “experience graph of human capital analytics” that uses AI to project returns on national investments in educational technologies (white paper here). Yet Analytics relies heavily on xAPI, developed by Problem Solutions under contract to the US Defense Department’s Advanced Distributed Learning initiative, to track “learning” that happens “anywhere” via mobile devices. Another division of HPE is Enterprise Blockchain Solutions, a crucial element needed to bring global impact investing to scale.

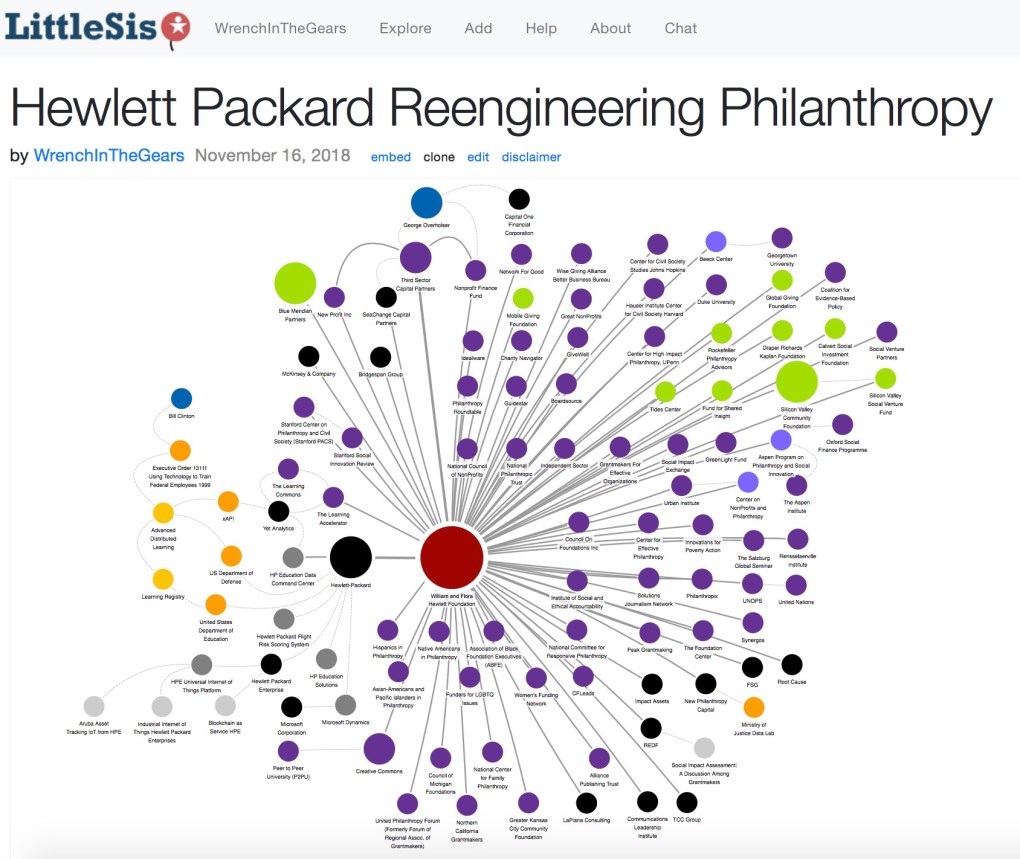

The map below shows the ways in which HP is connected to human capital management, online education delivery, and digital economic systems. Interactive version here.

Philanthropy Shopping Spree

Remaking the nonprofit sector to serve the needs of global finance capital is a complex undertaking, exactly the type of project for which the foundation of an influential technology company is particularly well suited. The William and Flora Hewlett Foundation distributed targeted grants of varying sizes to policy organizations, special interest groups, higher education institutions, think tanks, venture capital firms, and PR outlets. Often these grants were for general operating support which is notoriously hard to secure. Many grantees work within the United States, but a number have an international reach. In the following sections I will present a series of relationship maps that highlight how HP deployed their capital to create a supportive infrastructure for social impact investing. Below is the overall map of the foundations “effective philanthropy” grant recipients.

Interactive Map of ReEngineering Philanthropy here.

Below are HP’s grant recipients that work primarily outside of the United States. Interactive map here.

OER, Deeper Learning and Ed Reform 2.0

Paul Brest, see relationship map below, served as president from 2000 to 2012. Under his leadership the foundation made major investments in the development of Open Education Resources (OER) with over 300 grants awarded. OER is openly licensed material, primarily digital, a key element needed to scale online education delivered by curated playlists or algorithms, see the US Department of Education’s #GoOpen initiative. Grants were made in support of the Council of Chief State School Officers’ efforts to advance OER platforms like Gooru and UnboundEd.

Interactive map of Paul Brest here.

Brest also pushed “deeper learning” initiatives,” which align with mastery-based education and emphasize growth mindset, promoted by Stanford’s Carol Dweck. The foundation awarded two “deeper learning” grants totaling over $5 million to the Learning Policy Institute (LPI) based in Palo Alto and led by Linda Darling-Hammond, professor emeritus of education at Stanford University. LPI was created in 2015 as an education think tank to promote “evidence-based” research. Darling-Hammond works closely with Patrick Shields, a researcher with 20 years at SRI International. Beyond HP, LPI’s other funders include heavy-hitters in social impact investing, ed-tech, social-emotional learning, and competency-based education.

Interactive map of Learning Policy Institute here.

Brest spent much of his career as a professor and dean of the Stanford Law School. After joining HP he became an advisor to several behavioral science organizations including Ideas42. He currently lectures on social impact investing at the Stanford Graduate Business School where he is faculty co-director for the Center on Philanthropy and Civil Society. Brest also writes for the Stanford Social Innovation Review. In this 7-minute video from 2015 he discusses investments in Social Impact Bonds.

Venture Philanthropists

In a world of rising poverty, venture capitalists hope social impact investing and data-driven non-profit and public service management will keep their concentrated capital in motion. Hewlett Packard joined Blue Meridian Partners with a $10 million investment in 2016. The fund aims to aggregate a billion dollars to scale “high-performance” non-profit interventions in child welfare services. The fund is managed under the umbrella of the Edna McConnell Clark Foundation (Avon money), and the chair of the initiative is Stanley Druckenmiller who spent a dozen years overseeing Soros Fund Management LLC before moving on to start Duquesne Capital whose primary investments are in oil and energy. Druckenmiller is a close friend of Paul Tudor Jones (Robin Hood Foundation), and he has long served on the board of the Harlem Children’s Zone.

Interactive map of Blue Meridian Partners here.

The William and Flora Hewlett Foundation is a minor partner in this fund. Those making $50 million contributions include: The Ballmer Group (Steve Ballmer, Microsoft and Strive Together); Stanley Druckenmiller (Duquesne Capital, Harlem Children’s Zone); The Duke Endowment; George Kaiser Family Foundation (Bank of Oklahoma and Excelerate Energy); and The Samberg Family Foundation (Pequot Capital, Hawkes Financial Services, and Tri Alpha Energy Fusion Research). The David and Lucille Packard Foundation (ed-reform and early learning); the JPG Foundation (successor to the Picower Foundation); and Charles and Lynn Schusterman Family Foundation (oil and gas exploration, education reform and social-emotional learning) each contributed $10 million to the effort. A number of these foundations joined an earlier program in capital aggregation called the True North Fund through which the Edna McConnell Clark Foundation (EMCF) matched $30 million from the Social Innovation Fund, issuing awards to nine youth-serving grantees that agreed to impact evaluation and evidence-based program development.

EMCF was part of a very early impact investing convening co-sponsored in 2003 by the Goldman Sachs Foundation and the Rockefeller Foundation. That spring fifty individuals representing 31 foundations, financial institutions and funding intermediaries were invited to Goldman Sachs’s headquarters in New York to discuss social returns on investment in education / youth development and community development / employment. The aim was to collaborate in identifying common metrics that could be used to establish a cohesive market for social impact investing. EMDF, New Profit, the Roberts Enterprise Development Fund and Coastal Enterprises presented case studies at that event.

Two years later, America Forward’s “A Gathering of Leaders” would continue this discussion at Mohonk Mountain House in the Hudson River Valley. That meeting was intended to develop a “collective understanding of the barriers to growth and generate ideas for how we could release the potential of social entrepreneurs writ large to dramatically grow their impact.” A pivotal moment came when David Gergen, Harvard professor and former advisor to presidents Nixon, Reagan, and Clinton, admonished the group on the need to work within the existing governmental structure to “mobilize and support social entrepreneurs to directly engage in public policy advocacy.” It should be noted that Christopher Gergen, his son, is a social impact investor in Durham, NC. Christopher is an adjunct professor associated with the Duke Fuqua School of Business’s Center for the Advancement of Social Entrepreneurship (CASE), writes columns on social innovation for regional newspapers, and founded an online tutoring business that was later acquired by Pearson.

The Mohonk gathering outside New Paltz, NY became an annual event. In 2007 George Overholser, formerly managing team member for Capital One credit cards and founder of the Non Profit Finance Fund, pitched the creation of a $1 billion social investment fund. A refrain from his speech was the important role new technologies will play in monitoring “quality” and expenses in real time. This data will permit “proven” programs to scale via private impact investments. With Blue Meridian, eleven years later, the philanthro-capitalists are pretty close to achieving this vision.

Interactive version of map above here.

Several members of Blue Meridian Partners, including HP, are also members of the Fund for Shared Insight. That entity launched in 2014 to share information and create tools for assessing effective philanthropy, including surveys and feedback loops grounded in business management practice. Other core funders of the “shared insight” effort include the Gates, Ford, and Rockefeller Foundations.

In addition to Blue Meridian Partners a number of other impact investors have received foundation support. Interactive map of additional impact investors here

.

Think Tanks and Consultants

Interactive map of think tank grants here.

Non-Profit Finance Fund: Between 2012 and 2014 the William and Flora Hewlett Foundation made three separate $100,000 donations to the NonProfit Finance Fund to develop “tools and research on Social Impact Bonds.” George Overholser, a founding team member of Capital One, created the organization in 2007 and went on to launch Third Sector Capital Partners in 2011. Antony Bugg-Levine, formerly managing director of the Rockefeller Foundation and a co-founder and board member of the Global Impact Investment Network (GIIN) replaced Overholser as CEO.

Bridgespan: HP also awarded over $4.3 million to Bridgespan for general operating funds between 2002 and 2012. Bridgespan was spun out of Bain Capital in the late 1990s. Thomas Tierney, a Harvard MBA and former Bain Executive, created the organization to do consulting work specifically with the non-profit sector. Shortly thereafter, in 2003, Tierney joined the board of eBay where he worked closely as board chair with Pierre Omidyar. Omidyar advances social impact investing on a global scale through the Omidyar Network. Gates has poured over $30 million into the Bridgespan since 2000 to carry out ed-reform, turnaround, and global philanthropy projects. Bridgespan’s other co-founders include Jeff Bradach, a Harvard Business School professor specializing in organizational behavior who began his career at Bain, and Kansan Paul Carttar, another Bain alum who transitioned to a career as an independent consultant for the social entrepreneurship sector. Carttar is now busy launching a venture philanthropy fund in Africa.

Interactive map of Bridgespan here.

Above is the list of Gates Foundation Grants to Bridgespan. Direct link here.

Urban Institute: Another think tank that receives ongoing support from the foundation is the Urban Institute, which created a Center on Non Profits and Philanthropy in the late 1990s. A grant was given in 2003, the same year as the Goldman Sachs / Rockefeller Foundation philanthropy meet-up in New York, to underwrite the creation of a “framework to measure non-profit performance.” Three grants totaling $240,000 were awarded between 2012 and 2013 to develop PerformWell, a software platform for social service performance management including setting outcomes, benchmarking and data analysis, all of which feed into impact investing. Urban Institute’s philanthropy center has received $20,000 for general operating support annually since 2010. It is notable that with HP funding they also conducted an assessment of the nonprofit landscape in California in 2008 and later served as a technical advisor on the “Strong Start” pre-k Pay for Success initiative in Santa Clara County, CA.

Interative map of PeformWell here.

America Achieves: America Achieves is an “economic opportunity” think tank that works across education, government and economic sectors to developed “agile” (insert precarious and unstable) systems to “match the magnitude and pace of shifts in the economy” (cue robots and virtual agents). The William and Flora Hewlett Foundation has thus far directed over $1.5 million into Results for America, a program incubated at America Achieves that advances “evidence-based” policy making. Those funds were used between 2013 and 2015 to lobby the federal government to tie budget allocations to proof of impact. During that period Results for America launched their “Moneyball for Government” initiative.

HP also provided America Achieves funding to create a commission on student outcomes, to implement a national campaign around education needs, to study Common Core State Standards, and to implement personalized learning. They received general operating grants in the amount of $650,000 in 2013, 2015, and 2017. These funds were intended to support the promotion of “deeper learning” and the development of a global network of schools that would use the OECD Test for Schools for benchmarking and improvement purposes (again, think impact investing and their EIDCC program to assess ROI on ed-tech investments globally).

Other grants activity to think tanks include: $650,000 awarded between 2009 and 2011 to Root Cause, a Boston-based consultancy that scales “high-performance” nonprofits and has worked with Open Society Foundations; $2.6 million in general operating support to Harvard-affiliated FSG consulting, plus additional special project funds for work in foundation evaluation practices and global network facilitation; and a single $100,000 grant to the Rensselaerville Institute to help practitioners with “outcomes thinking.”

Higher Education

Getting prestigious institutions of higher education on board with this program was also a priority. The tide of social entrepreneurship lifted many boats, and numerous academic institutions have been set up with new programs to advance research and policy development in the impact investing space. The William and Flora Hewlett Foundation issued modest grants in the $100,000 range to the Beeck Center at Georgetown, the Center for Civil Society Studies at Johns Hopkins, and the Center for High Impact Philanthropy at the University of Pennsylvania. Larger grants of around half a million dollars were given to Duke (close ties to David Gergen) and the Hauser Center for Civil Society at Harvard.

Much more substantial awards were made to the Stanford Center on Philanthropy and Civil Society, which is located in HP’s backyard. The foundation supported the operations of the center to the tune of over $6 million since 2006 with awards increasing in recent years and additional gifts made in 2016 to create a new website, purchase a CRM system and develop a communications plan. The center have become a research hub for social impact investing. It publishes the Stanford Social Innovation Review and awards digital impact grants that foster a metrics-oriented approach to service delivery via its Digital Civil Society Lab. Laura Arrillaga-Andreessen, daughter of prominent Silicon Valley commercial real estate developer John Arrillaga and wife of Netscape co-founder Marc Andreessen, founded the center in 2006 and built up the social impact program within the Stanford Graduate School of Business. She also created the Silicon Valley Social Venture Fund, which was incubated within the Silicon Valley Community Foundation for ten years before spinning out in 2008.

Interactive map of higher education grants here.

Influencers

HP also targeted national network groups, the organizations best positioned to establish industry norms for the social sector and train its leaders as change agents. In 2015 the foundation awarded a $10 million grant to the National Philanthropic Foundation for a “New Partnership for Children and Youth,” however no details were given on the website. They directed over $6.7 million in general operating support to the Center for Effective Philanthropy, plus an additional $1.5 million for a youth survey project targeted at Bay Area students, and smaller grants for strategic planning, professional development and national conferences. $1.7 million in general operating funds went to the Foundation Center, which also received grants for their Foundation Center Online, videoconferencing, GrantCraft curated online giving re sources, and a donor management system. Additional grantees included: The National Council on Nonprofits, Peak Grantmaking, Grantmakers for Effective Organizations, Council on Foundations, Institute of Social and Ethical Accountability, National Committee on Responsive Philanthropy, and the Independent Sector.

Interactive map of influencers here.

Evaluation Platforms

Charitable giving is slated to become a largely decentralized online marketplace where elite social investors will be able to vet a range of proposals before adding to their philanthropic portfolios. The Alice software platform, underwritten by Nominet Trust in the UK, provides a glimpse into where things may be headed. A bleak op-ed from the National Review this June envisions Blockchain smart contracts emerging as a means by which crowd-sourced peer-to-peer charity replaces the public welfare system entirely.

Moving forward, a charity’s or social service provider’s potential for “impact” will be determined via data-driven metrics that are benchmarked against peer institutions. Software and evaluation frameworks that underlie this structure are vital to the system’s operation. Data must be collected, organized, and made available as part of the impact assessment process. Just as online school ratings systems have been normalized by Greatschools.org, there is a charity rating enterprise GreatNonProfits.org, which has received over $600,000 in general operating support from the Flora and William Hewlett Foundation since 2009.

For the time being, humans are the ones reviewing the data dashboards. However some anticipate a day when algorithms and even AI will replace people in making impact investment decisions, as already is the case for much high-frequency trading. See this 2015 whitepaper from the Charities Aid Foundation in the UK “Giving Unchained: Philanthropy and the Blockchain.”

The map below depicts evaluation systems into which HP has invested. These include: Guidestar, Give Well, and Wise Giving Alliance. Idealware and Network for Good are grant recipients that provide guidance to non-profits on software purchases, while Boardsource offers training and development for non-profit leaders. The last grantee on this map, Mobile Giving Foundation indicates the degree to which app-based philanthropy and digital payment systems are supplanting traditional ways of giving.

Interactive Map of Evaluation Platforms here.

Special Interest Groups

HP also directed grants to umbrella organizations that serve foundations with a specific social or cultural affiliation or geographic focus. Most received small, recurring general operating grants in the amount of $15,000 to $20,000. The entities representing regional foundations received larger distributions. The Kansas City Community Foundation received the most with over $3 million awarded between 2003 and 2010 for the development of DonorEdge, a non-profit database compiling regional financial, operational and programmatic information. In 2008 Guidestar took over the operation of DonorEdge, which is used by more than a dozen community foundations across the country.

Interactive Interest Group Map here.

Public Relations

All successful campaigns require a communications plan to sell it to the public. This final map features private firms and non-profit media outlets that the William and Flora Hewlett Foundation funded through their “effective philanthropy” program. I have already written extensively about Solutions Journalism Network within the context of vertically integrated “impact media” here. HP has given this media outlet $1.72 million since 2014. The largest gift by far was a $1 million donation made in 2017. Most of the funds were for general operating, though a grant was made for website design and another for development of a “social listening tool.”

HP maintains an ongoing investment in the UK social impact publication Alliance Magazine, awarding $10,000 annually to support free access to its content. In 2002 and 2003 they funded Philanthropix, a photography provider that aids nonprofits in communicating their stories ($450,000). HP also retained Communications Leadership Institute to conduct outreach to policymakers and develop a program to train grant recipients, specifically community college leaders in California, in communications. Lastly, a 2008 grant in the amount of $172,000 was used to hire, in partnership with the David and Lucille Packard Foundation and the James Irvine foundation, the TCC Group to run sessions intended shift the organizational behavior of twenty-seven community organizing groups in California, reported on here.

Interactive Grants Messaging Map here.

After reviewing all of these grant maps, I hope the massive scale of this systems engineering project is clear. The William and Flora Hewlett Foundation injected tens of millions of dollars over the past fifteen years in an effort to transform the philanthropic community of the United States into a conducive environment for data-driven, outcomes-oriented, evidence based grant-making. HP pursued its goals systematically and strategically. The one question still outstanding is whether or not non-profits will be able to sufficiently scale to accommodate the massive influx of Pay for Success capital that is expected. Next up in the Toxic Philanthropy Series will be an examination of the Silicon Valley Community Foundation (SVCF), the largest community foundation in the country with assets of over $13 billion. The William and Flora Hewlett Foundation made a sizable contribution in 2006 that made it possible for SVCF to be created from the merger of The Peninsula Community Foundation and The Community Foundation Silicon Valley.

Wow, Jeremiah, two of your best (part 1 & 2).

From Part 1: I was invited as a visiting scholar to ASU/GSV a few years back (because a mere school principal or teacher can’t afford to go) and within 10 minutes I realized I was in the middle of a crony capitalism deal making feeding frenzy, and that real educators who ended up there were only serving as window dressing. Was not a single educational idea at the “education“ conference that I could find to take home with me (though plenty of ineffectual AI vaporware on display funded by billionaire philanthropy)

From Part 2: just one delicious example out of this hurricane of non-practitioners who constitute the “education experts“: Linda Darling Hammond, “education expert” (after one whole year in a classroom, she left to become an expert) couldn’t even found one successful school, with all the resources of Stanford behind her and the education “experts” who teach at the education school, but who apparently never bothered to master the classroom, the place was a predictable disaster. https://www.nytimes.com/2010/04/16/education/16sfcharter.html

…all reflected in today’s ridiculous 10 #LinkedInTooVoices …education influencers lall professors and investors not a single teacher or principal.

OK, that’s it for me, just remember Jerusalem was still burned to the ground despite all Jeremiah’s dire, and accurate, warnings. Maybe he wasn’t getting through to the right potential allies!?

And seems to me crucial to be able to distinguish between the people who put years on the ground figuring out how to help children vs. the MBAs, real estate investors and bond salesman who are looking to exploit them… friends and enemies of children… for instance what would you say to this fellow from your city? Would you attack him like you did me as “part of the problem“!? http://phillys7thward.org/2018/09/racist-colleague-spews-hate-address-remain-silent/ He wouldn’t have any patience with blanket attacks on him or all Charter Schools (like his where they’re doing great work) or a complete dismissal of any Ed Tech, without which it is completely impossible to close huge learning gaps in math and reading (and with it it’s fairly easy) or to end systemic poverty. But what he could use is advice from Jeremiah on how to defend himself and his organizations against the wolves in sheep’s clothing who want to “invest” in the good work of the successful practitioners… those willing to endure the relative poverty and to spend the years needed to learn their trade.

>

Thanks for the thoughtful comment and sharing your experience. Do you mind me asking your feelings about the Harlem Children’s Zone? Because as I have done this research it has become increasingly clear that many, many social entrepreneurs have their hands all over the programs and metrics tied to service delivery, education and otherwise, in that community. This is happening through Paul Tudor Jones’s Robin Hood Foundation primarily. My sense is that the prototype will be scaled nationally through Strive Together and the target of those interventions will be black and brown communities and indigenous communities.

OK I finally found this comment from you… I don’t usually look at the WordPress app. So I may have answered you by email but: I am on the West Coast so I don’t have any recent experience on the East Coast (except for the year I spent in Rhode Island running a Montessori MathScience adolescent program in 2010). I’m sure there are lots of “entrepreneurs” trying to get reading scores etc. up in that neighborhood. The need to raise reading scores is real and the fundamental crisis in our democracy is the death of reading*- but people with MBAs are not likely to do so